Many entrepreneurs advocate establishing multiple streams of income as the road to financial success. But how do you manage multiple small business interests at once? To make the multiple streams of income approach work, it’s a good idea to proceed cautiously and with careful, deliberate planning so you don’t spread yourself too thin. With a few small tips and the hard work that you already do, you can diversify your income and make more money.

Managing Multiple Small Business Incomes at Once

Focus Your Energy

One of the questions you may have is whether to take a focused, one-business-at-a-time approach, or to go with the “shotgun” approach of moving forward on establishing several streams of income simultaneously. While there isn’t a definitive answer, and much of the answer may depend on your personality type, the general consensus is that focusing on one business endeavor at a time usually leads to more substantive results for you, including more revenue and profitability in a shorter time frame.

For example, the well-known investing entrepreneur, Robert Kiyosaki, author of the “Rich Dad, Poor Dad” book series, took a serial approach to building multiple income streams, first establishing a business as a real estate investor, then adding other investments, and finally leveraging his knowledge into creating a self-help publishing business.

Create Passive Income Streams

Passive income streams are those that, once you establish them, continue to generate revenues with only minimal effort and attention. A classic example of creating a passive income stream is writing a book. Once you write it, the book continues to generate revenue for you without a lot of ongoing work on your part. Most passive income streams require little more than ongoing marketing efforts.

An increasingly popular passive income stream comes from producing educational or entertaining videos. Popular YouTube channels generate substantial advertising revenues, and once you create the video, users can view it again and again. A logical second business is sharing your expertise in your primary business, such as offering consulting services or leading educational seminars. Other potential passive income efforts include franchising your existing business or implementing affiliate marketing on your website.

Separate Multiple Small Businesses

It’s a good idea to treat each of your small business ventures as a separate entity, with its own accounting records and resources. That way you can identify which ventures are driving the most profitability and determine the best ways to improve and invest in each. Some business ideas just don’t Social Insurance out, and the best use and preservation of your resources involves recognizing and discarding a bad idea as soon as possible.

Regular reviews of each individual business may also enable you to identify problems with one of your businesses that you can then take steps to correct before the problem grows. You can refocus your energy to take corrective steps on the struggling business.

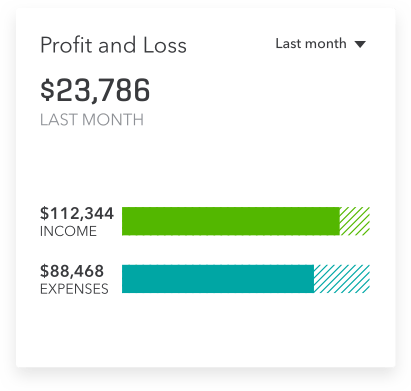

As a small business owner, you want to make a profit and create a successful venture. Improve your cash flow with invoices, payments, and expense tracking. See how much cash you have on hand with QuickBooks.