Download free financial statement templates including balance sheets, cash flow, and income statements and get a better understanding of your company’s finances.

Handling your small-business finances requires more than just knowing what’s in your bank account. These three financial statements provide a snapshot of the financial health of your business. This will allow you to get a better handle on your accounting and can be a useful tool when courting investors or applying for a small business loan.

Business owners use different types of financial statements to get a better picture of the company’s current financial state. Each of the three main financial statements focuses on a particular aspect of your finances. While an entire set of financial statements tells the complete story of an organization, each report can stand on its own for different purposes and is often used for external reporting.

QuickBooks Online will automatically fill in all the necessary financial reports for your business. With a simple look at your dashboard, you’ll have all the information you need to make those important business decisions.

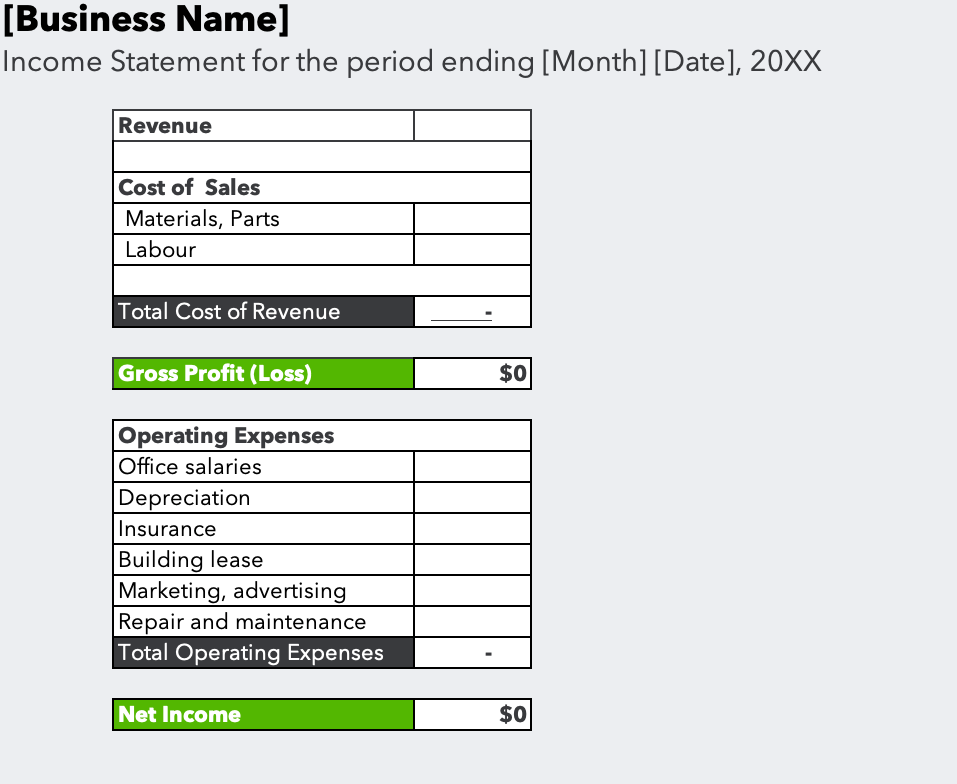

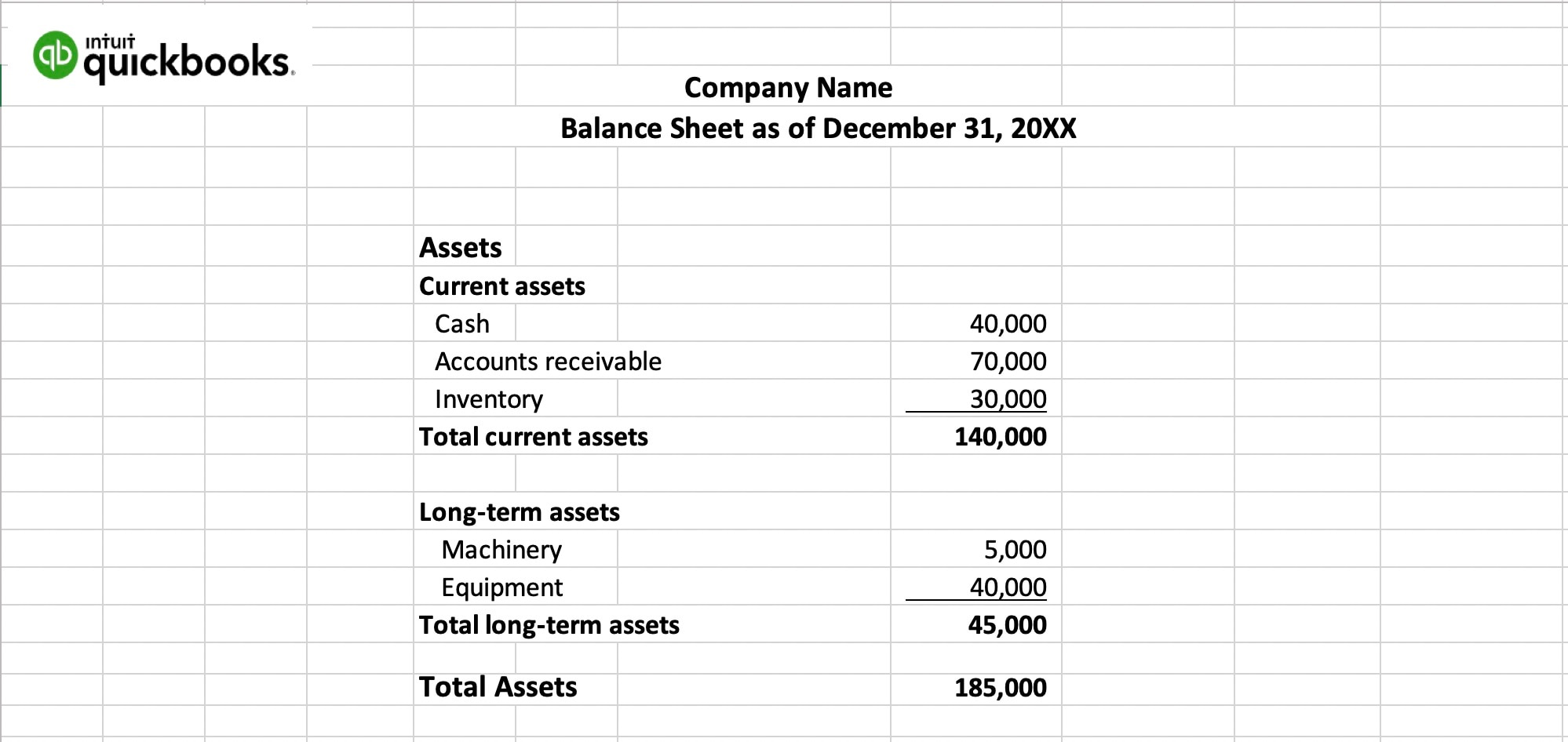

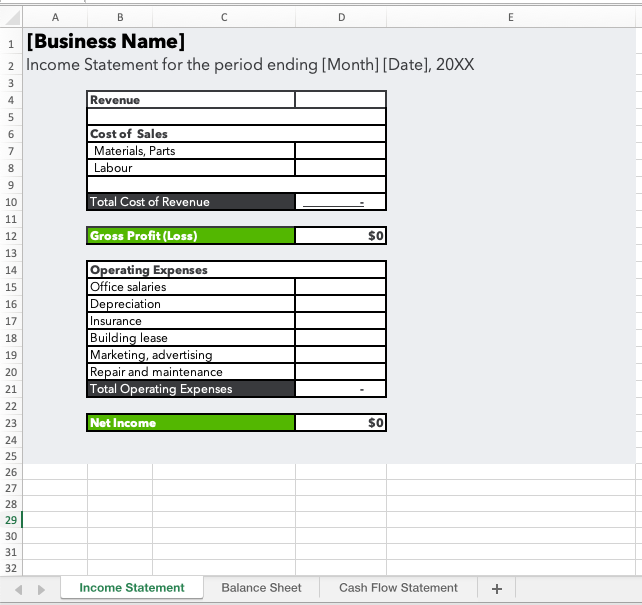

We’ve made it easy for you to compile all of your financial statements in one place. Download our template to record your income and cash flow, as well as put together a balance sheet.

Back: What is Accounting and How Many Types are There?