No business, regardless of its type or size, is immune to fraud. However, small businesses are particularly vulnerable due to their lack of resources for monitoring and preventing fraudulent activities. Over 40% of fraudulent activities occur internally, often perpetrated by long-time employees or business partners. It is even more challenging to detect before significant financial losses have occurred, leaving a business vulnerable.

Preventing Fraud in Your Small Business

Proactive Businesses can Effectively Fight Fraud

The best way to protect yourself is by staying knowledgeable and implementing measures that will make criminals think twice before they commit fraud. The most common forms of fraud experienced by small businesses are:

- Billing fraud

- Check tampering

- Revenue skimming

- Expense reimbursement fraud

Most small businesses can't afford the average annual loss of $155,000. That's why installing fraud detection and prevention measures is essential before you suspect fraud. Even with limited resources, small businesses can gain the upper hand on fraud by focusing on eight key strategies.

8 Ways to Enact Fraud Prevention in Your Business

1. Establish Internal Accounting Controls

Employees commit most fraud activities with access to the business's bank account and accounting operations. Fraudulent invoicing or supplier billing fraud are typical activities involving employees who oversee both the invoicing and payment functions. Prevent this type of fraud by installing some internal control measures.

- Separate the accounting functions. While it can increase staffing costs, it can prevent the most commonly perpetrated fraud.

- Have the business owner or head of operations review and/or approve all invoices.

- Conduct an internal accounting audit by certified fraud examiners, at least annually.

2. Know Your Employees

Your hiring practices should include thorough background checks and reference checks with past employers. Fraudulent activities are more likely to be perpetrated by established employees who become disgruntled or financially burdened. Maintain close contact with your employees to watch for changes in personal circumstances, temperament or productivity. Conducting frequent one-on-one meetings and regular reviews create opportunities to uncover possible red flags.

You can also train your employees to detect suspicious behaviour, such as phishing emails.

3. Implement a Visible Anti-Fraud Policy

Businesses that spend a lot of time discussing fraud with their employees tend to experience less of it. By making it an issue with a proactive education and communication process, businesses put their employees on notice that fraud is not going to be tolerated. Put a positive spin on the discussion by making your employees feel they have a stake in the business and that fraud prevention keeps the business strong. A practical and visible anti-fraud policy should include the following:

- A policy statement outlining the types of fraud and the company's position on how it will deal with them.

- An employee code of conduct.

- A management review process of all activities that are susceptible to fraud.

- Fraud education and training.

- An anonymous reporting system

4. Create an Anti-Fraud Hotline

Most small business fraud is detected as a result of a tip hotline. Employees who feel they have a stake in good health of their company are more willing to report a suspected fraudulent act if they could do so anonymously through a designated website or phone line. The capability to report fraudulent activities should also be extended to customers, suppliers, suppliers, and even acquaintances of the suspected perpetrator.

5. Keep detailed and secure records

Keeping detailed and secure records is the simplest way to protect yourself from fraud. Missing or disorganized documents will make it easier for people to fabricate inventory records and manipulate transaction reports. Therefore, keeping your information organized will prevent any loopholes that criminals can use to their advantage.

Money coming in and going out should all be recorded, and constantly updating your inventory reports. Inspect cancelled cheques to ensure suppliers are recognized, expenses are related to company business, the qualified signers authorize signatures, and endorsements are appropriate.

Reconcile business bank accounts monthly and ensure that all records and cheques have date stamps and signatures and are filed accordingly. This way, you can easily track items at a moment's notice and ensure that no cheques are out of sequence.

It is also a good idea to periodically implement random audits, so criminals don't have time to alter reports. This tactic may also scare them off from committing fraud in the future.

Keeping your records online can also have its advantages in fraud prevention. This is because you will be able to set passwords and only allow specific individuals access to your accounts. So in case fraud occurs, you will be able to track who had access to sensitive information and narrow down a list of potential suspects.

To ensure maximum security, install antivirus software to protect yourself from hackers trying to gain access to your accounts.

6. Get insurance

Unfortunately, criminal activity can come from external and internal sources of your business. Employee or electronic fraud can cause severe damage to your business, so having business insurance with a broad range of coverage will help protect you in case you do fall victim to crime. Insurance companies such as AON cover your business from various criminal acts, including fraud.

Coverage includes:

- Burglary and robbery

- Money and securities theft

- Employee fraud and dishonesty

- Electronic fraud or forgery.

7. Audit Your Books Regularly

A 2020 report by Kroll and the IIA revealed that businesses that implement and invest in internal audits improve their fraud risk management effectiveness. Audits will ensure that financial statements align with account records and will be able to decipher if any misalignment is caused by errors or fraud.

Internal audits play a vital role in not only helping to reduce the financial and reputational impact of fraud but also in preventing detriment to business growth and objectives.

The audit procedure may include:

- The review of economic activity within your company as a whole

- The review of individual activity of management and employees

- Evaluation of tasks

- Conformity of accounting entries

- Evaluation of reports, assets and capital

The sooner you detect fraud, the easier it will be to mitigate damage to your company. Making insurance claims can also be made easier from audited accounts.

8. Use the Right Tools

Fraud makes businesses and their customers vulnerable to loss of money, products, reputation, and exposure of sensitive data. Additionally, customers may lose trust in the compromised business and look for alternative providers.

Fraud detection tools such as Fraud.net enable businesses to detect high-risk, fake, or illegitimate online transactions. Good detection tools should be able to continuously monitor all the transactions, user behaviour, devices, and other metrics. They then analyze and calculate the risk scores to determine or detect potentially fraudulent transactions such as illegal purchases or access, ad click spam, bots, stolen cards, and more.

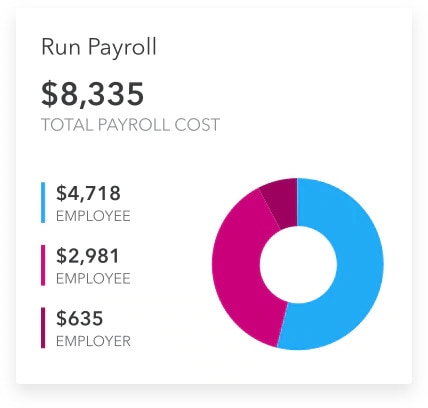

Tools like comprehensive accounting software can help you keep track of your finances as they move in and out of the business. With QuickBooks Online, you can use cash flow tracking, financial reporting, and expense and revenue categories to keep an expert eye on your finances to ensure everything is as it's supposed to be.