How to Switch to Direct Deposit

There are many advantages to switching to direct deposits and now that you know some of them, you may be wondering how to set it up for your own business. Below are some steps for setting up a direct deposit system that meets all your business needs.

To set up direct deposit, an employer must:

1. Choose a schedule:

You can decide on a pay schedule of biweekly, weekly, or monthly. Most companies in Canada choose a biweekly pay schedule.

2. Choose a system:

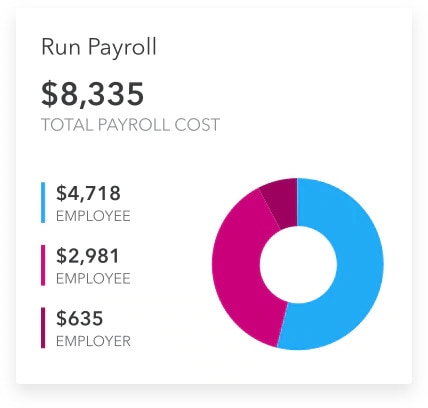

You can choose between an in-house system or outsourcing payroll. Unless you are an accounting expert, you will likely need help calculating payroll, and if you decide that in-house is good for your business, then automating a payroll system is probably your best bet. QuickBooks Online + Payroll is a great solution for completing your payroll accurately and on time.

3. Create a company account:

When setting up direct deposit, you have to consider which financial institution you want to process your payments through. Your chosen bank will largely depend on your business needs and personal preferences. Look out for e low business account fees, rewards cards, and transaction fees.

4. Collect and verify employee information:

To set up direct deposit, you’ll need your employee’s banking information, like bank account number, routing number, bank name and address and the name of the account holder. You can find this information on a voided cheque or direct deposit form that employees can access through online banking or a teller.

5. Register with the CRA:

After opening a business account and setting up a direct deposit, you must register your business with the CRA to obtain a business number. When business owners register for a business number, they will also register for the program accounts they require. For direct deposit, you should ensure you're registered for payroll deductions (RP) to ensure your employees get the proper remittances deducted from their pay cheques.