Cost of Payroll

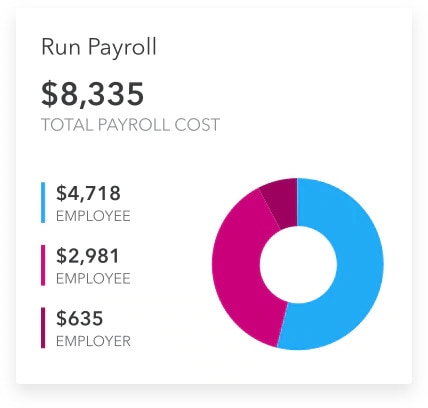

The argument against in-house payroll often centres around the costs of a dedicated staff person and the hard resources required to meet a payroll every week or two weeks. You have to pay that person a salary and benefits, which adds to your overall expenses.

Eliminating the staff function for payroll in favour of outsourcing may result in savings, and it eliminates other costs associated with payroll, such as technology, materials, and fees. Even if the cost of outsourcing is equivalent to the cost of payroll processing internally, the business can realize savings through an increased level of operational efficiency.

When you handle payroll yourself, you can also save money on the process. You may have to pay for the payroll app you use, but you aren’t paying a salary for a full-time payroll staff member or paying for outsourced payroll services.

But when you focus on payroll, you’re taking yourself away from potentially income-generating activities. Adding a staff member or a payroll company to your expenses may generate enough extra revenue to justify the expense when you can focus on those other activities.