Whether you are self-employed or own a small business, the responsibility of filing taxes will fall to you. With all the rules and regulations surrounding this subject, you may be left wondering, how do you file taxes in Canada? Here are the things you’ll need to know when filing your small business tax returns this season.

Filing your small business taxes? Here’s what you need to know

How to prepare for tax season

On top of all the records you need to prepare for tax time, you must also know what tax credits you can claim and which expenses to deduct. All of this compiling and filing of taxes must then be completed before the government deadlines. Deadlines will vary based on if your business is incorporated or if you are self-employed. June 15th 2023 is the deadline for self-employed individuals to file their taxes. Whereas incorporated businesses have up until 6 months after their fiscal year to file their taxes. For example, if your corporation's tax year ends in March, you will need to file by September.

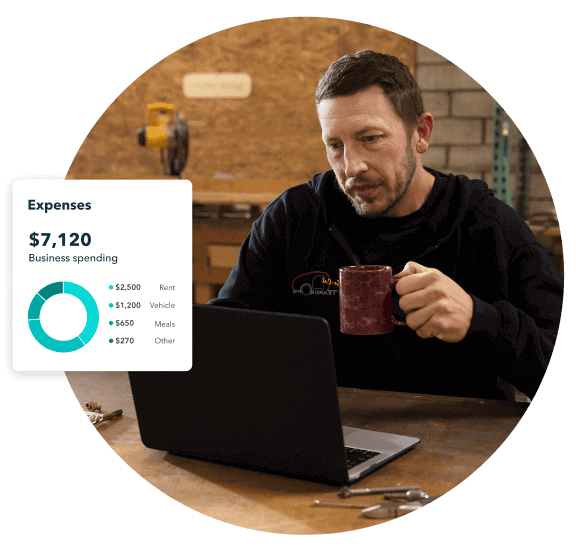

Business owners are responsible for keeping documentation of all business-related expenses from the past 6 years. These records can be helpful when it comes time to deduct expenses and make tax credit claims. Examples of records include:

- Financial statements

- Invoices

- Receipts

- Cheques

- Tax returns

- Bank and credit card statements

Documents you need to file small business taxes

There are many different accounting documents and business records you must collect come tax time. Download this small business tax checklist to ensure you have all the required documents needed to file your returns.

Once you’ve filled out the required tax forms and collected all applicable financial documents, what comes next?

CRA forms you need to complete

Once you’ve collected all applicable financial information and records, you’ll have to fill out the appropriate Canada Revenue Agency (CRA) forms for your business. The forms you are required to file will depend upon your business structure.

T2 Corporation Income Form

If your business is incorporated, you will need to file specific forms with your returns. The T2 form serves as a federal, provincial, and territorial income tax return for corporations in Canada. However, for those located in Alberta or Quebec, you must file a separate provincial corporation return. All residential corporations must file a T2 return every tax year, even when there is no tax payable. The only exemptions include registered charities, Crown corporations, and Hutterite colonies.

You can file your T2 form electronically using the internet, as in most cases, the CRA mandates electronic filing. To do so, you must use CRA certified software to fill in the forms accordingly. Once the forms are complete, you can submit your tax files online, or print them off and submit by mail. Keep in mind that T2’s are due up to 6 months after the business's fiscal year.

ProTax is a cloud-based software built into QuickBooks Online Accountant, covering basic T2 tax forms, and is fully CRA certified.

Self-Employed Form T4A and T2125

Self-employed individuals and contractors are required to fill out forms T4A and T2125 when filing their taxes. The T4A (also known as the Statement of Pension, Retirement, Annuity and Other Income) slip will allow contractors or freelancers to keep track of how much they earned from each of their clients throughout the year.

Form T2125, also known as the Statement of Business or Professional Activities, helps individuals calculate their gross income and business expenses to lower their taxable income. Find out more about these self-employment tax forms.

Filing small business and personal taxes together

The ability to file your business taxes alongside your personal taxes will depend upon the structure of your business. A business owner who operates a corporation must file their corporate taxes separately from their personal taxes. Conversely, small businesses that run as sole proprietorships and partnerships are required to report their business taxes on their personal income tax returns.

Best ways to file taxes with ease

Previously, individuals and businesses had to fill out all of their tax information by hand. However, these days, thanks to technology, many individuals opt to use software to fill out their taxes as it makes the whole process easier and minimizes the risk of human errors.

There are typically three main options to choose from when filing your taxes. These include using tax software and submitting your taxes online, using software and filing through the mail, or using a professional service to file them on your behalf.

File with tax software

Canada Revenue Agency must certify the tax software you use to file your taxes. Suppose you are using software that has not been approved, this could result in your taxes not being filed properly and may lead to unwanted penalties.

File taxes online

Once your taxes are complete, you will have the option to submit your files online through various CRA e-services.

Business owners who file GST/HST, payroll, and corporation income taxes can use the My Business Account portal. Those who report their business income on a personal income tax return can do so with the My Account portal.

Use NETFILE

NETFILE is another available electronic service that allows individuals to file their taxes online. It is a transmission service that allows eligible Canadians to file their personal income taxes online directly to the Canada Revenue Agency. To use NETFILE, you must first have NETFILE-certified tax software.

Submitting taxes this way will simplify the filing process, as it allows you to file directly through the software. Filing through NETFILE also means you will have immediate confirmation when the CRA receives your taxes. You won’t have to send in your receipts (unless they specifically ask for them later). Suppose you are eligible for a refund after your returns have been reviewed. In that case, you will also receive your tax refund faster by way of a direct deposit to your account.

File taxes by mail

If you opt to submit your taxes through the mail instead of online, you will need the tax centre mailing address to send in your income tax and benefit returns to the CRA.

First, you will need to print off all forms and fill in the necessary paperwork. It would be best to look over your full return before placing it in an envelope to be sent off. Insurance and tracking services should be applied to your package before sending it through the mail, to be safe.

It typically takes four to six weeks for the CRA to process a tax return sent to them by mail.

Filing your sales taxes

As the owner of a small business, you will be responsible for filing your income tax returns, as well as your sales tax returns. Whether you provide services or a product to the public, you will need to charge and collect sales tax on your customer transactions. The sales tax charged, either GST, PST, or HST, or a combination of the three, will differ based on the products sold and where in Canada you are located. Learn more about the provincial sales tax here.

Once you’ve collected your sales tax for an accounting period, you will need to send this money to the CRA. Depending on your filing periods, you will need to file sales taxes monthly, quarterly, or annually. To help you prepare your sales taxes and determine if you are required to file online or through the mail, the CRA recommends using the GST/HST Return Working Copy.

Filing your sales tax returns online

Like income returns, there are various options for individuals and businesses to file their sale tax returns online. GST/HST NETFILE and GST/HST TELEFILE allow individuals to file their sales tax returns directly online, and are the quickest and easiest options to use. As previously stated above, the My Business Account is also available for filing sales taxes, alongside other business-related taxes.

Individuals can also pay their net tax owed electronically through their Canadian financial institution using the Electronic Data Interchange option (EDI). However, those in Quebec will be unable to use this electronic service. Other internet-based filing services include the GST/HST Internet File Transfer, offering business owners the ability to pay their sales taxes to the CRA directly through their third-party accounting software.

Filing your sales tax returns by mail

If you determine you do not need to file your sales tax online, you will be able to file a paper return to the CRA. Eligible individuals can either send the GST/HST return through the mail using forms GST34-2 or GST62, or file in person at your Canadian financial institution.

However, be aware that you cannot file your sales return in person at a financial institution if you are claiming a refund, filing a nil return, or opting to offset the owing amount on your return with a rebate or refund.

Professional accounting help to file your your business taxes

Those who might not have the best grasp on financial matters might choose to hire a professional accountant or bookkeeper to file their taxes for them. If you opt for accounting services, they will handle all of your returns and will file them online through the CRA portal, Represent a Client.

However, if you opt to file your own returns, the CRA dictates you must hold onto all your tax documents for at least six years. Hence, keeping organized tax files is a significant part of any business or person’s tax management.

Understanding the tax return process can help small businesses organize all of the required information to file their returns successfully. Be prepared for this tax season with QuickBooks accounting software. Try it free today!