Monday - Friday, 9 AM to 6:30 PM ET

All the tools you need to save time and confidently run your business

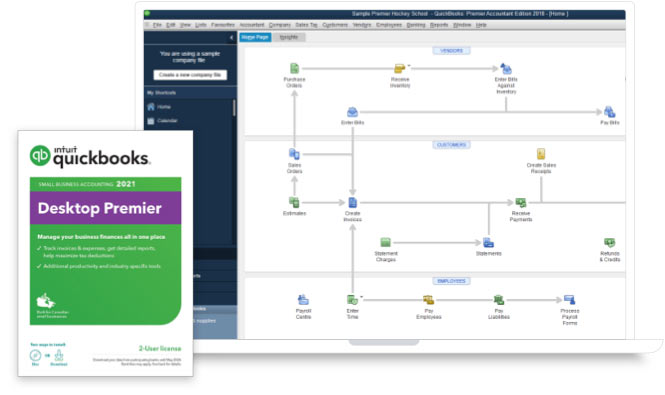

Create invoices and track sales

Easily create invoices and sales receipts to keep track of who owes you money, what they bought, and when they paid you.

Gain insights into your business

Track how your business is doing with one-click financial, tax and sales reports.

Reconcile online banking

Save time on data entry - download your online bank transactions1 direct into QuickBooks.

Stay on top of your expenses

Clearly see bills and purchase orders at one place. Track what’s paid or owed, and take immediate action on unpaid bills.

EFILE GST/HST to the CRA2

Save time, paper and stamps - with just a few clicks send your GST/HST forms electonically to the CRA.

Batch Delete Transactions

Save time by removing duplicate transactions or entry errors from the forms sections in a single step.

New features

Get paid faster

By automatically reminding customers when payments are due.

Create a consistent, professional look

By leveraging style and design templates for your customer communications.

Complete all your tasks faster

With 64 bit processing power that will allow you to run reports, create invoices, and reconcile accounts at quicker speeds

Need to pay employees?

Save time running right inside QuickBooks with the QuickBooks Desktop Pro + Payroll bundle.

Quickly pay employees

Simply enter hours and let QuickBooks Payroll do the rest.4

Easily remit payroll taxes

QuickBooks Payroll tracks provincial and federal taxes and automatically fills in T4/RL-1 forma, making them simple to remit - even EFILE2.2

Automatically stay up to date

We automatically send you payroll updates when they become available, so your tax tables are always up to date.5

Straightforward pricing

Simply select the QuickBooks Desktop Pro solution that is right for you and how many people will use it.

1 user

Starting as low as

$47/mo

- Create professional invoices

- Track sales and expenses

- Manage accounts payable

- One-click sales and tax reports

3 users

Starting as low as

$99/mo

- Create professional invoices

- Track sales and expenses

- Manage accounts payable

- One-click sales and tax reports

1 user

Starting as low as

$97/mo

+$4/employee per month

- Create professional invoices

- Track sales and expenses

- Manage accounts payable

- One-click sales and tax reports

- Quickly pay employees in three easy steps

- Easily remit payroll taxes

- Automatically stay up to date and worry-free

3 users

Starting as low as

$149/mo

+$4/employee per month

- Create professional invoices

- Track sales and expenses

- Manage accounts payable

- One-click sales and tax reports

- Quickly pay employees in three easy steps

- Easily remit payroll taxes

- Automatically stay up to date and worry-free

Need more users or extra support? We’re here to help. 1-888-829-8589

System requirements

- Windows 8.1 or Windows 10 update/version supported by Microsoft

- Windows Server 2012 (or R2), 2016 or 2019

- 2.4 GHz processor

- 4 GB of RAM (8 GB recommended)

- 2.5 GB disk space recommended (additional space required for data files)

- 4x DVD-ROM drive

- Payroll and online features require Internet access (1 Mbps recommended speed)

- Product registration required

- Optimized for 1280x1024 screen resolution or higher

- Supports one workstation monitor, plus up to 2 extended monitors

- Optimized for Default DPI settings